Current state of the market: scale, growth, and forecasts for hydrogen transport

January 15, 2026Hydrogen transport is moving from pilot projects into structured market development, driven by decarbonization targets, industrial policy, and the limitations of battery-electric solutions in heavy-duty mobility. While adoption remains uneven across regions and applications, hydrogen-powered transport is increasingly viewed as a strategic component of long-term zero-emission mobility, particularly for buses, trucks, rail, and commercial fleets.

The hydrogen transport market is still relatively small compared to conventional automotive segments, but its growth trajectory reflects rising investment, expanding infrastructure plans, and sustained government support. Market assessments now focus less on early feasibility and more on scalability, cost curves, and deployment readiness. Let's examine the current scale of the hydrogen transport market, key growth dynamics, and forward-looking forecasts to provide a grounded view of where the market stands today and how it is expected to evolve over the next decade.

Global hydrogen transport market overview

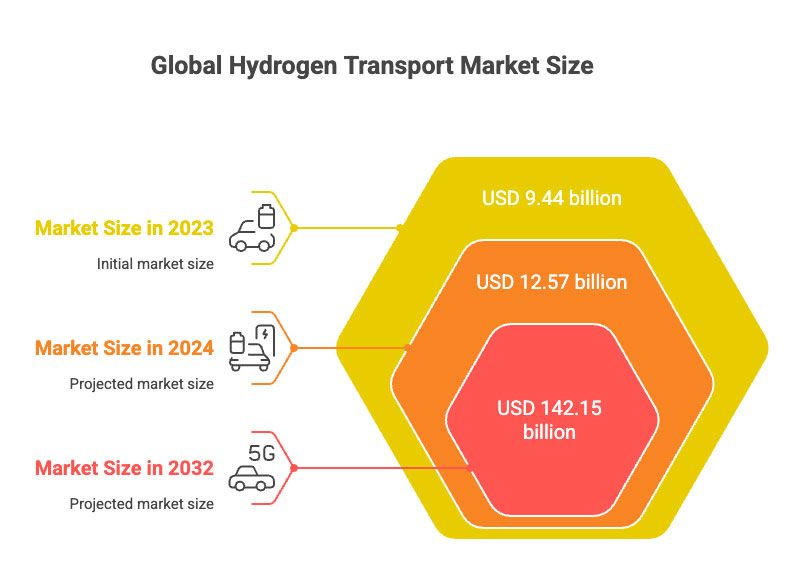

The global hydrogen transport market remains in an early growth phase but is expanding steadily as fuel cell technologies transition from demonstration to limited commercial deployment. According to Fortune Business Insights, the global hydrogen vehicle market size was valued at USD 9.44 billion in 2023. The market is projected to grow from USD 12.57 billion in 2024 to USD 142.15 billion by 2032, exhibiting a CAGR of 35.4% during the forecast period.

Asia-Pacific currently represents the largest share of hydrogen transport activity, led by Japan, South Korea, and China, where national hydrogen strategies explicitly support fuel cell vehicles and refuelling networks. Europe follows with a strong focus on hydrogen buses, regional rail, and cross-border freight corridors, while North America shows more selective adoption concentrated in fleet and pilot-heavy-duty applications. Importantly, transport represents only one segment of the broader hydrogen economy, but it plays a visible and strategic role. Unlike industrial hydrogen use, transport adoption is tightly linked to the availability of public infrastructure, vehicle cost reductions, and operational reliability. As a result, market scale today reflects not only vehicle sales, but also the pace at which refueling networks and fleet deployments can be expanded in parallel.

Key growth drivers shaping hydrogen mobility

Growth in hydrogen transport is driven not by a single factor but by the combined effects of policy commitments, technological progress, and changing fleet economics. Understanding how these drivers interact is essential for assessing the market’s medium- and long-term trajectory.

Key factors accelerating hydrogen transport adoption include:

- National hydrogen strategies and zero-emission mandates, creating long-term policy certainty.

- Public funding for vehicles and refuelling infrastructure that reduces early-stage deployment risk.

- Limitations of battery-electric solutions for long-range and heavy-duty transport.

- Improving fuel cell efficiency and durability, lowering operational and maintenance risk.

- Fleet decarbonization pressure from public authorities and corporate sustainability targets.

- Corridor-based deployment models, enabling scalable rollout without nationwide infrastructure coverage.

Policy and regulatory drivers

Government policy remains the primary catalyst for the adoption of hydrogen mobility. National hydrogen strategies, zero-emission transport targets, and climate legislation increasingly position hydrogen as a complementary solution to battery-electric mobility, particularly in segments where electrification faces technical or operational limits. Subsidies for fuel cell vehicles, funding for refuelling infrastructure, and public procurement programs for buses and rail have reduced early deployment risk and created anchor demand. In many regions, hydrogen is also embedded in broader industrial and energy transition frameworks, reinforcing long-term policy commitment rather than short-term experimentation.

Technology and infrastructure development

Technological maturity is improving steadily across the hydrogen value chain. Fuel cell systems are becoming more efficient and durable, while gradual cost reductions in stacks, balance-of-plant components, and hydrogen storage are improving total system performance. At the same time, investments in refuelling infrastructure are addressing one of the main bottlenecks to adoption. Although infrastructure density remains limited, early corridor-based and depot-focused models are enabling targeted commercial use, particularly for buses, trucks, and rail applications.

Fleet economics and operational fit

From an operator's perspective, hydrogen transport adoption is increasingly evaluated based on total cost of ownership rather than upfront vehicle cost alone. For high-utilization fleets, long range, fast refuelling, and predictable duty cycles can offset higher capital expenditure. Hydrogen-powered vehicles also offer operational advantages in heavy-duty and continuous-use scenarios where battery weight, charging time, or grid constraints limit feasibility. As fleet operators seek scalable zero-emission solutions that minimize operational disruption, hydrogen is gaining traction as a viable option in specific use cases rather than a universal replacement.

Market segmentation: vehicles, applications, and regions

The hydrogen transport market is not developing uniformly. Adoption patterns vary significantly depending on vehicle type, operational use case, and regional policy and infrastructure readiness.

Segmentation by vehicle type

Hydrogen adoption is most advanced in heavy-duty and high-utilization vehicles. Buses represent one of the most mature segments, driven by public procurement programs and centralized refuelling at depots. Hydrogen trucks are emerging in long-haul and regional freight scenarios, where range and refuelling speed are decisive factors. Rail applications, particularly on non-electrified lines, are also gaining momentum as an alternative to diesel. Passenger vehicles remain a smaller segment, constrained by limited refuelling infrastructure and higher per-unit costs.

Segmentation by application

Public transport and commercial fleets dominate current deployments, benefiting from predictable routes, centralized operations, and policy support. Logistics and freight applications are expanding more cautiously, often through pilot corridors and fleet trials. Industrial and port-related mobility represents a niche yet growing segment in which hydrogen can be integrated into existing energy and industrial hydrogen supply chains.

Regional market differences

Asia-Pacific leads in vehicle deployment and infrastructure density, supported by long-standing national hydrogen strategies. Europe emphasizes cross-border coordination, public transport, and rail decarbonization, while North America shows selective adoption focused on fleet-based and heavy-duty use cases. These regional differences reflect varying policy priorities, infrastructure investment models, and market readiness levels.

Market size projections and growth forecasts

Market forecasts for hydrogen transport reflect a transition from experimental deployments toward early commercial scaling rather than rapid mass adoption. Projections referenced by Fortune Business Insights indicate a strong double-digit CAGR through the 2030s, expanding the market from a relatively small base into a multi-billion-dollar segment. Growth is expected to be concentrated in buses, trucks, and rail, driven by public-sector procurement, fleet decarbonization mandates, and corridor-based infrastructure rollouts. Passenger vehicles are forecast to grow more slowly, reflecting ongoing refuelling and cost constraints. Regionally, Asia-Pacific is projected to maintain its leading position in absolute market size, Europe to show steady policy-driven growth, and North America to expand selectively through heavy-duty and fleet-focused deployments. These projections remain highly sensitive to assumptions around infrastructure build-out, hydrogen pricing, and policy continuity.

Constraints, risks, and market maturity outlook

Despite strong policy support, hydrogen transport faces structural constraints that continue to shape adoption. Infrastructure remains the most significant limiting factor, with refuelling networks still sparse and uneven. Without synchronized growth in vehicle deployment and infrastructure investment, scaling remains difficult. Cost is another critical challenge. While technology costs are declining, hydrogen-powered vehicles still carry a capital premium, and the volatility of hydrogen pricing complicates long-term planning for fleet operators. In addition, fragmented standards and regulatory frameworks across regions increase complexity and deployment costs.

As hydrogen transport deployments scale beyond pilot projects, operational visibility and safety monitoring become critical. Kaa’s remote hydrogen monitoring platform provides centralized visibility across distributed hydrogen assets, including refuelling stations, storage systems, and transport-related infrastructure. Continuous data collection, real-time alerts, and historical records help operators manage risk, support regulatory compliance, and enable safer expansion as hydrogen transport networks grow. As a result, the hydrogen transport market is best described as early-commercial rather than mass-market-ready. Adoption is advancing where operational fit, policy alignment, infrastructure development, and digital oversight converge, particularly in controlled fleet and corridor-based models.

You may be interested in: Hydrogen detection market: size, trends, forecasts, and key figures

Conclusion

The hydrogen transport market has moved beyond technical feasibility into a phase defined by scale, economics, and coordination. Data and forecasts point to meaningful growth potential in heavy-duty transport, public fleets, and rail, segments where hydrogen’s advantages are clearest and policy support is strongest. At the same time, the market remains uneven and sensitive to infrastructure readiness, hydrogen cost trajectories, and regulatory alignment. Rather than a single global adoption curve, hydrogen transport is evolving through region- and segment-specific pathways. In this context, hydrogen transport should be viewed as a strategic, long-term component of zero-emission mobility rather than a universal solution. The coming decade will determine where hydrogen reaches sustainable scale and where it remains a targeted, specialized technology within the broader clean transport landscape.