Hydrogen detection market: size, trends, forecasts, and key figures

December 23, 2025Hydrogen infrastructure in the United States is scaling faster than the industrial risk-management practices traditionally used to support it. Projects that once existed as isolated pilots are now being deployed as multi-site systems with long operating lifespans, significant capital investment, and growing regulatory oversight. This way, the core challenge is no longer whether it can be deployed safely, but how safety is maintained consistently across assets, locations, and operating conditions.

This has clear market implications. Hydrogen detection is increasingly specified as part of a broader operational and compliance framework, in which buyers evaluate coverage, system integration, data availability, and long-term operating costs alongside sensor performance. Against this backdrop, the hydrogen detection market is entering a phase of accelerated, structurally driven growth.

Market context and why hydrogen detection matters

Hydrogen presents a distinct safety profile compared to conventional industrial fuels. It is colorless, odorless, and highly diffusive, and it ignites at very low concentrations. In operational environments such as production halls, compressor rooms, storage areas, and refueling stations, even minor leaks can escalate rapidly if they are not detected early. In the US, these physical risks intersect with a tightening regulatory and insurance environment.

Hydrogen projects are increasingly subject to requirements for continuous monitoring, documented safety controls, and incident traceability. Insurers and financiers are also applying stricter scrutiny, often requiring demonstrable detection coverage and operational monitoring before projects are approved or insured. As a result, hydrogen detection has moved upstream in project design. Systems are now defined during the engineering and procurement stages rather than added later as a compliance checkbox. This change directly influences capital approval, insurance terms, and operational readiness, making detection integral to hydrogen infrastructure rather than an auxiliary component.

Global market size and forecast

In absolute terms, the hydrogen detection market remains relatively modest. However, its growth rate reflects the early-stage expansion of hydrogen infrastructure rather than a mature replacement cycle.

Aggregated industry estimates place the global hydrogen detection market at several hundred million dollars today, with expectations that it will roughly double by the end of the decade. Forecasts from Markets and Markets consistently point to a compound annual growth rate in the low double digits, driven primarily by new installations tied to infrastructure build-out.

The United States is expected to account for a significant share of this growth. Federal incentives, public–private partnerships, and private investment are accelerating the adoption of hydrogen across energy, transportation, and heavy industry. Compared to earlier initiatives, many current US projects are designed for scale from the outset, with safety systems specified as part of the initial architecture rather than retrofitted later.

A defining feature of the market is its close alignment with capital investment cycles. Demand for hydrogen detection systems scales directly with the deployment of electrolyzers, storage facilities, pipelines, and refueling stations. Because many of these projects are already funded or under construction, medium-term market visibility is relatively strong.

Compact hydrogen detection market figures overview

Figures below reflect aggregated analyst estimates and infrastructure investment trends.

| Metric | Global | United States | Notes |

|---|---|---|---|

| Estimated market size (mid-2020s) | ~$0.25–0.30B | ~$0.07–0.09B | Hardware and systems |

| Forecast market size (2030) | ~$0.50–0.55B | ~$0.15–0.18B | Infrastructure-driven growth |

| Expected CAGR | ~11–12% | ~13–15% | US growth exceeds the global average |

| Largest region by volume | Asia-Pacific | North America | The US leads in North America |

| Fastest-growing applications | Energy, refueling | Energy, industrial | Safety-led demand |

Source: Markets and Markets analysis

Key growth drivers and limiting factors

Growth in the hydrogen detection market is driven by structural forces tied to how hydrogen projects are financed, regulated, and insured in the US.

Key growth drivers include:

- Expansion of hydrogen production, compression, storage, and distribution infrastructure;

- Increasing regulatory emphasis on continuous monitoring and auditable safety controls;

- Rising insurance and investor scrutiny of hydrogen-related operational risk;

- Rapid growth of hydrogen refueling networks and industrial-scale usage.

At the same time, practical constraints influence procurement decisions and system design.

Primary limiting factors include:

- Higher upfront cost of hydrogen-grade sensors compared to conventional gas detectors;

- Ongoing calibration and maintenance requirements;

- Integration challenges in facilities with legacy control and safety systems.

These constraints direct buyer focus from sensor price alone toward the total cost of ownership. Centralized monitoring, automation, and remote diagnostics are increasingly viewed as essential to making hydrogen safety operationally and economically sustainable at scale.

Technology and application landscape

The hydrogen detection market encompasses multiple sensor technologies, each suited to specific operating conditions. Electrochemical sensors are widely used for their sensitivity at low concentrations, while catalytic sensors remain common in heavy industrial environments. MOS, thermal conductivity, and MEMS-based sensors are selected where durability, compact form factor, or scalability is prioritized.

In practice, most facilities deploy a combination of sensor types rather than standardizing on a single technology. Environmental conditions, detection thresholds, redundancy requirements, and regulatory expectations all influence system architecture. From a deployment perspective, fixed detection systems account for the majority of market growth, as continuous monitoring is required in production, storage, and processing environments. Portable detectors remain relevant for maintenance and inspections, but represent a smaller share of long-term demand. Application growth is strongest in energy production, hydrogen refueling infrastructure, and industrial manufacturing.

How Kaa enables remote hydrogen monitoring at scale

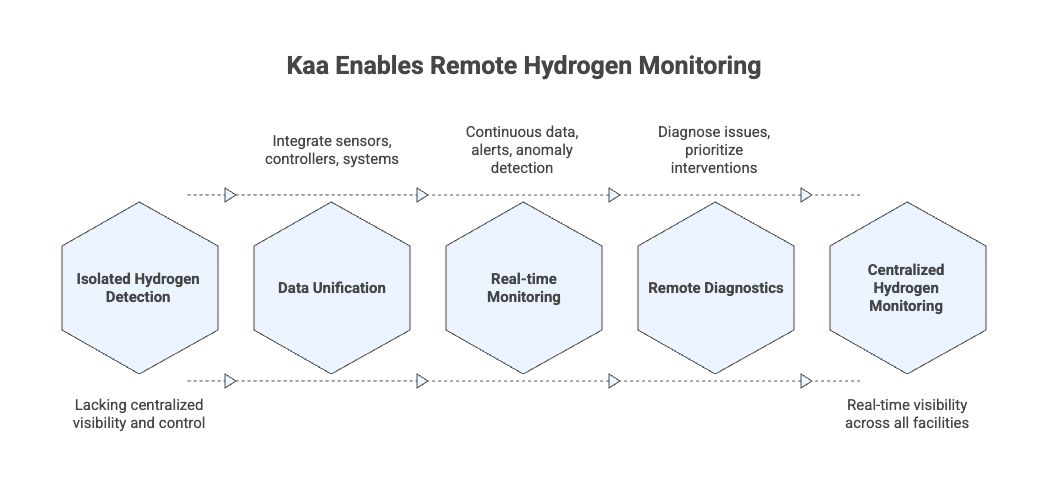

Detection alone is not sufficient to manage operational risk. Multi-site deployments require centralized visibility, consistent alarm logic, and auditable data to meet regulatory, insurance, and operational expectations. Kaa provides a remote hydrogen monitoring solution that unifies data from sensors, controllers, and supporting systems into a single operational layer. Rather than managing detection devices in isolation, operators gain real-time visibility across facilities, regions, and asset types.

The platform supports continuous data collection, real-time alerts, and anomaly detection, enabling rapid response to abnormal conditions such as leaks or system deviations. Historical data is retained to support compliance reporting, incident investigation, and performance analysis. Remote monitoring reduces reliance on frequent site visits and manual data checks. Engineering teams can diagnose issues remotely, prioritize interventions based on risk, and verify system health without disrupting operations. This approach is particularly suited to US hydrogen deployments, where assets are often geographically dispersed and managed by lean teams.

Final takeaway

The hydrogen detection market is transitioning from a niche segment of industrial safety to a critical layer of hydrogen infrastructure. In the US, regulatory pressure, insurance requirements, and the scale of deployment are accelerating the adoption of integrated detection and monitoring systems. Since hydrogen projects grow larger and more distributed, value is shifting away from individual sensors toward platforms that provide visibility, control, and accountability across the entire asset lifecycle. Hydrogen safety is no longer just about detecting leaks – it is about managing risk at scale.