What is FEOC and why it matters for the U.S. energy market

October 28, 2025In 2025, “FEOC compliance” has become one of the defining forces shaping the future of the U.S. clean-energy transition. The term Foreign Entity of Concern (FEOC) identifies which foreign organizations, components, and technologies that are restricted from receiving federal incentives or participating in government-funded energy projects. This classification matters because recent updates from the U.S. Department of Energy (DOE) and the Internal Revenue Service (IRS) explicitly tie FEOC compliance to eligibility for Inflation Reduction Act (IRA) tax credits, DOE grants, and even utility-linked rebate programs.

In practice, this means clean energy products like batteries and inverters can lose millions of dollars in potential incentives if they are more than 45% sourced from suppliers ultimately controlled by a FEOC, most notably China. But China is not the only country affected: FEOC restrictions also apply to entities under the jurisdiction of Russia, Iran, and North Korea.

Businesses across the U.S. are actively seeking FEOC-compliant technologies that guarantee operational reliability, transparent data handling, and long-term regulatory eligibility. At Kaa, we see this shift firsthand. As we prepare to launch a new battery data-reading device for the U.S. market, the message from our partners is clear: energy independence now includes digital independence.

Definition and legal background

The Foreign Entity of Concern (FEOC) designation was first defined under the Infrastructure Investment and Jobs Act (IIJA, 2021) and later adopted into the Inflation Reduction Act (IRA) to strengthen the transparency and security of U.S. clean-energy supply chains. The DOE and IRS use this definition to determine which entities and components qualify for federal funding, tax incentives, or participation in national energy programs.

In December 2023, the Department of Energy released its final interpretive guidance on the FEOC definition, clarifying ownership thresholds and the concept of effective control. The intent behind these measures is straightforward: to ensure that technologies critical to national energy infrastructure are not dependent on foreign governments that pose economic or national-security risks.

Under current law, the following countries are designated as covered nations: China, Russia, Iran, and North Korea.

According to DOE guidance, a company or component can be considered an FEOC if it meets one or more of these criteria:

- It is incorporated or operates under the jurisdiction of a covered nation.

- It is owned, controlled, or directed by the government of such a nation.

- It has board members or shareholders acting on behalf of those governments.

- It relies on key technology, intellectual property, or licensing from an entity in a covered nation.

In short, FEOC status is not determined solely by where a product is manufactured; it depends on who ultimately controls it. That distinction now defines whether clean-energy companies in the U.S. can qualify for IRA-backed incentives, DOE funding programs, or utility rebate schemes.

FEOC rules and compliance requirements

The FEOC restrictions already shape who can access billions of dollars in clean-energy incentives under the IRA and related DOE initiatives. Beginning in 2024 and tightening further in 2025, manufacturers and integrators working with batteries, solar components, and electric vehicles must demonstrate FEOC compliance to secure federal tax credits and grants.

Under IRA Section 30D (Clean Vehicle Tax Credit), vehicles lose eligibility if their batteries contain components manufactured or assembled by an FEOC. Starting in 2025, the rule expands, even if critical minerals inside the battery are extracted, processed, or recycled by a FEOC, the credit is forfeited.

The same principle applies to Section 45X (Advanced Manufacturing Production Credit) and Section 48E (Clean Electricity Investment Credit). Solar or storage projects that include FEOC-linked wafers, inverters, or control electronics risk disqualification from these credits and related reimbursements. The DOE also applies FEOC standards when evaluating applications for grants and loan programs, while many state-level utility rebate programs now mirror the same criteria to align with federal compliance frameworks.

For suppliers, FEOC compliance goes far beyond confirming a component’s country of origin. It requires:

- Documenting ownership and governance structures of manufacturing partners.

- Tracing subcomponent sources and raw materials to confirm non-FEOC control.

- Ensuring that firmware, cloud systems, and data hosting are not operated by covered-nation entities.

In effect, FEOC compliance has become a new standard of due diligence, blending supply-chain transparency with national-security alignment. For companies in the battery and solar sectors, proving this compliance is now as essential as meeting technical, environmental, or safety certifications.

Impact on solar and battery supply chains

The FEOC framework is reshaping how American clean-energy companies design and procure their systems. What was once a conversation about cost or performance has become a matter of supply-chain eligibility. For OEMs, installers, and developers, the key question is no longer “Can this component deliver the right output?”, but rather “Will this component keep our project eligible under IRA and DOE rules?”

To stay compliant, U.S. developers and OEMs are overhauling procurement practices. Many now require full traceability of critical materials such as lithium, nickel, and graphite to verify that these inputs were not extracted or refined under FEOC control. Others are building parallel supplier networks in the U.S., Canada, and allied nations to ensure compliance across every layer, from hardware sourcing to firmware integration. This transition toward “FEOC-free” supply chains is quickly becoming the industry baseline. Beyond protecting access to federal incentives, it reinforces both energy sovereignty and digital trust, ensuring that U.S. infrastructure depends on transparent, auditable, and geopolitically stable technologies.

Kaa’s role: FEOC-compliant data devices for battery monitoring

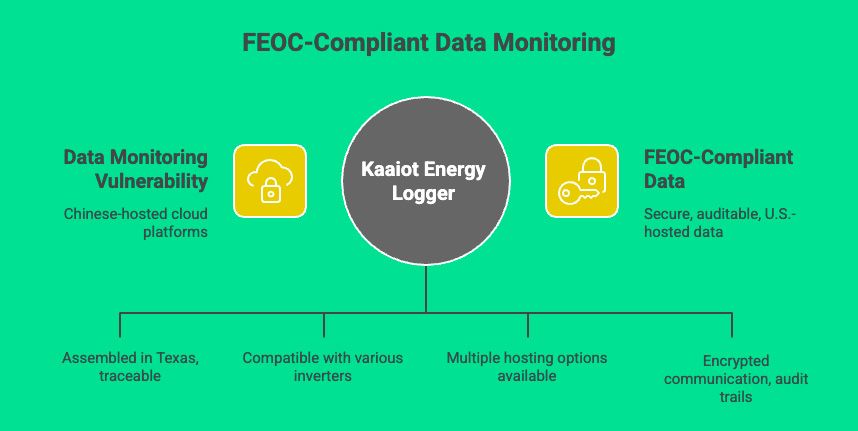

As the clean-energy sector adapts to FEOC restrictions, one of the least visible yet most vulnerable areas is data monitoring. Many affordable loggers and inverter gateways still depend on Chinese-hosted cloud platforms, which create compliance, data-sovereignty, and security challenges that can jeopardize eligibility for DOE or IRS programs. The Kaaiot Energy Data Logger was built to address this exact issue. It is a U.S.-made, FCC-pending (Q4 2025) edge device designed for transparent, FEOC-compliant energy monitoring. Acting as a bridge between inverters and IoT platforms, it collects and transmits performance data securely via MQTT, with all information stored locally rather than on foreign or overseas clouds, including those in China.

Key advantages:

- Manufactured and assembled in Texas, ensuring full traceability and compliance with U.S. jurisdiction.

- Vendor-neutral Modbus integration – compatible with a wide range of inverters commonly used in the U.S. market.

- Flexible hosting options – Kaaiot Cloud, Kaaiot Hosted, Kaaiot Self-Hosted, or a customer’s own MQTT broker.

- Enterprise-grade security with per-device authentication keys, encrypted communication, and complete audit trails.

The result is a monitoring device that perfectly aligns with FEOC compliance objectives: energy data remains within U.S. or allied infrastructure, ownership stays with the operator, and every integration is open, secure, and auditable. At Kaa, we focus on one layer of the ecosystem – data visibility and control. We don’t build the full solar or battery system; instead, we provide a trusted interoperability layer that restores digital independence to the energy data chain. For integrators, OEMs, and utilities, this means a clear path to meeting transparency and compliance standards without sacrificing flexibility or performance.

Practical takeaways for U.S. integrators and OEMs

FEOC regulations have transformed compliance into a central part of project strategy. For system integrators, EPCs, and OEMs, the following actions can minimize exposure and secure long-term eligibility for federal incentives:

- Verify supplier ownership and governance. Ensure that no supplier in your chain is owned, controlled, or directed by entities from China, Russia, Iran, or North Korea. Review registration documents and shareholder structures before finalizing contracts.

- Map component origins. Trace the source of critical materials, battery cells, and electronics. Even U.S.-assembled equipment can lose eligibility if subcomponents originate from FEOC-controlled entities.

- Maintain compliance documentation. Keep detailed records verifying non-FEOC status; these are increasingly required for DOE grants, IRS audits, and state rebate programs.

- Favor local and allied manufacturing. Collaborating with FEOC-compliant U.S. or partner-nation vendors simplifies due diligence and strengthens qualification for IRA Sections 30D, 45X, and 48E.

Ultimately, FEOC policies are driving a shift toward transparent, sovereign supply chains. Companies adopting open, independent technologies will not only meet compliance goals but also gain a competitive advantage in reliability and trust. The Kaaiot Energy Logger is one small yet essential component of that movement, helping U.S. energy firms maintain both data clarity and regulatory confidence in an evolving market.

Conclusion

The FEOC framework is reshaping the U.S. clean-energy landscape. Once a safeguard against foreign control, it now drives decisions in sourcing, finance, and technology across solar, storage, and EV sectors, from raw materials to operational software. For American firms, compliance defines access to federal incentives and investor trust.

At Kaa, we view FEOC as a driver of innovation and transparency. Our Kaaiot Energy Logger, built and supported in the U.S., enables secure asset monitoring and full data ownership, advancing a cleaner, more autonomous energy infrastructure where control stays with those who create and operate it.