Onsite solar paired with storage: from operating expense to strategic energy asset

February 10, 2026For decades, commercial energy management treated electricity as a variable operating expense: externally priced, largely uncontrollable, and reactive. That assumption no longer holds. Structural changes in electricity demand, price volatility, grid constraints, and carbon accounting are forcing organizations to reconsider how they source, manage, and value energy. Onsite solar paired with battery storage represents a shift in this model. Instead of relying exclusively on market-priced electricity, businesses introduce physical energy assets into their operations – assets that reshape cost exposure, operational resilience, and sustainability performance.

This article explains how onsite solar and storage work in commercial settings, why adoption is accelerating globally, and under what conditions these systems become strategically relevant.

Energy volatility as a structural risk

Electricity markets in the United States are not merely experiencing short-lived price swings; they are undergoing structural shifts in demand, supply, and price behavior that significantly affect business cost exposure and operational risk. Recent forecasts from the U.S. Energy Information Administration (EIA) and market reporting show rising demand, upward price pressure, and increased system stress from new load growth, especially in commercial sectors such as data centers and electrified loads.

Increasing U.S. electricity demand

According to Reuters, U.S. electricity consumption is projected to reach record levels in both 2025 and 2026, driven by expanded economic activity, electrification of heating and transportation, and rapid growth in data-intensive sectors such as AI computing and cryptocurrency operations. According to the EIA, total U.S. electricity demand is expected to rise from around 4,097 billion kWh in 2024 to over 4,260 billion kWh in 2026, representing sustained growth after years of relatively flat consumption patterns. This increase is structurally different from short-term weather-related spikes; it reflects ongoing shifts in underlying load drivers, with commercial and industrial demand growing alongside residential consumption.

Wholesale and retail price trends

Wholesale power prices, reflecting fuel costs, generation mix, and market demand, are rising in key U.S. regions. The EIA forecasts that the average U.S. wholesale electricity price in 2025 will be around $40/MWh, roughly 7% higher than in 2024, with larger increases (30%-35%) in parts of the Southwest and California due to fuel costs and grid constraints. Independent reporting confirms this trend: during the first half of 2025, wholesale electricity prices in the U.S. increased by nearly 40 % year-over-year, averaging about $48/MWh, largely driven by higher natural gas prices and system operating conditions. Retail electricity prices, paid by commercial customers for delivered energy, are also rising faster than inflation and are expected to continue increasing through 2026 in many states.

Emerging load patterns and grid stress

The concentration of new electricity demand, especially from data centers and AI-related computing loads, is placing localized stress on regional grids. In some markets, projected demand growth has prompted grid operators and policymakers to consider new market mechanisms that require large power users to participate in reliability planning or provide self-generation resources. This dynamic illustrates a broader shift: energy demand growth is not homogeneous across consumer segments or regions but is increasingly driven by high-intensity loads that can affect capacity planning and price formation, raising peak demand, tightening margins, and increasing risk for traditional energy procurement models.

Onsite solar as a production layer in commercial energy systems

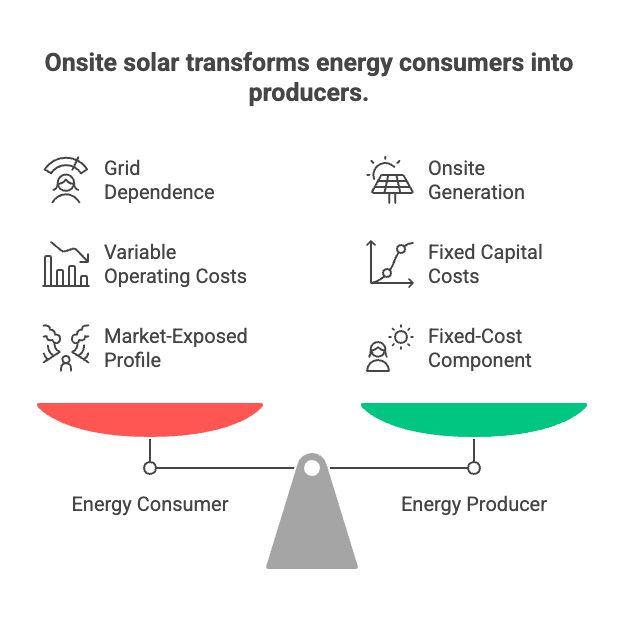

Onsite solar converts a facility from a pure energy consumer into a partial producer. Photovoltaic (PV) systems installed on rooftops, parking canopies, or adjacent land generate electricity behind the meter, supplying power directly to onsite loads before drawing from the grid.

This configuration does not eliminate grid dependence. Instead, it reduces the volume of electricity purchased at market prices and shifts part of the energy supply from variable operating expenditure to long-lived capital or contract-backed assets. Modern commercial PV systems typically operate for 25–30 years, with predictable performance degradation and maintenance requirements. From a system perspective, onsite solar introduces a fixed-cost generation component into an otherwise market-exposed energy profile. This change alone improves long-term cost predictability but does not fully address timing mismatches between generation and consumption. That role is fulfilled by storage.

Storage as the control and resilience layer

Battery storage fundamentally changes how onsite solar functions. Without storage, excess solar generation is either exported to the grid or curtailed, while peak demand periods may still rely on expensive grid electricity.

When paired with storage, solar generation becomes dispatchable within defined limits. Stored energy can be used to:

- Shift consumption away from peak pricing periods;

- Reduce demand charges by shaving short-duration load spikes;

- Improve utilization of onsite renewable generation;

- Provide limited backup power during grid outages, subject to system design and regulatory constraints.

It is important to distinguish between resilience and full backup capability. Battery systems are sized based on specific objectives: peak management, short outage coverage, or operational continuity for critical loads. Storage does not automatically imply full facility backup, and performance depends on battery capacity, discharge duration, and local interconnection rules.

Financial mechanics and cost predictability

Traditional electricity procurement exposes businesses to fuel prices, regulatory changes, and demand-driven price spikes. Onsite solar alters this exposure by replacing a portion of variable-priced electricity with generation at a largely fixed cost. Financial outcomes depend on local incentives, load profiles, and market conditions, but many commercial installations achieve payback periods of 3 to 5 years. After payback, the marginal cost of generated electricity is low and predictable. Even where upfront capital expenditure is undesirable, power purchase agreements (PPAs) allow organizations to secure long-term price stability without owning the asset.

Storage enhances these economics by reducing peak demand charges and increasing the effective utilization of solar generation. While batteries introduce additional capital and replacement costs, their economic role is increasingly tied to avoided peak costs and reduced operational risk rather than energy arbitrage alone.

Compliance, Scope 2 accounting, and additionality

Sustainability commitments are becoming increasingly technical in nature. Corporate frameworks such as RE100 increasingly emphasize additionality – the requirement that renewable energy claims be backed by new or directly contracted generation rather than unbundled certificates. Onsite solar directly satisfies this requirement by adding new renewable capacity at the point of consumption. When paired with eligible Energy Attribute Certificates (EACs), onsite systems provide a transparent and auditable pathway to Scope 2 emissions reduction. Storage further strengthens this position by aligning renewable generation with actual consumption patterns, reducing reliance on grid electricity during high-emission periods. For organizations subject to ESG scrutiny, this alignment improves both reported metrics and audit credibility.

Organizational and asset-level implications

Beyond cost and compliance, onsite solar and storage influence how facilities are valued and operated. Buildings with onsite generation benefit from reduced operating expense volatility and improved resilience, which can translate into higher asset attractiveness for tenants, investors, and lenders.

For employees and external stakeholders, visible renewable infrastructure also signals operational commitment rather than abstract policy intent. While these effects are secondary to financial and operational drivers, they contribute to long-term organizational positioning. Importantly, onsite solutions are not limited to large enterprises. Small and medium-sized organizations can access similar benefits through third-party financing structures, provided their load profiles and site characteristics support viable system sizing.

When onsite solar and storage become strategic

Onsite solar paired with storage is not universally optimal. Its strategic value emerges under specific conditions:

- High exposure to peak electricity pricing or demand charges;

- Volatile or rising wholesale electricity markets;

- Sustainability targets requiring demonstrable additionality;

- Operational sensitivity to grid disruptions;

- Long-term occupancy or asset ownership horizons.

In these contexts, energy shifts from a passive expense to an actively managed operational variable. The critical step is not installation, but evaluation, understanding load behavior, site constraints, regulatory rules, and financial objectives.

Conclusion

Energy management is no longer solely a procurement function. As electricity markets become more volatile and sustainability requirements more stringent, organizations are reassessing how energy fits into long-term strategy. Onsite solar paired with storage introduces controllable generation and flexibility into commercial energy systems. When properly designed, these assets reduce exposure to market volatility, support compliance-driven decarbonization, and enhance operational resilience. The result is not independence from the grid, but a more balanced, predictable, and strategically managed energy profile. In this model, energy moves out of the expense column and into the category of long-term operational assets – measured, managed, and aligned with broader business objectives.